claim workers comp taxes

Wills Trusts. First even though you dont always have to pay taxes on most workmans comp sometimes you may have to report it to the IRS.

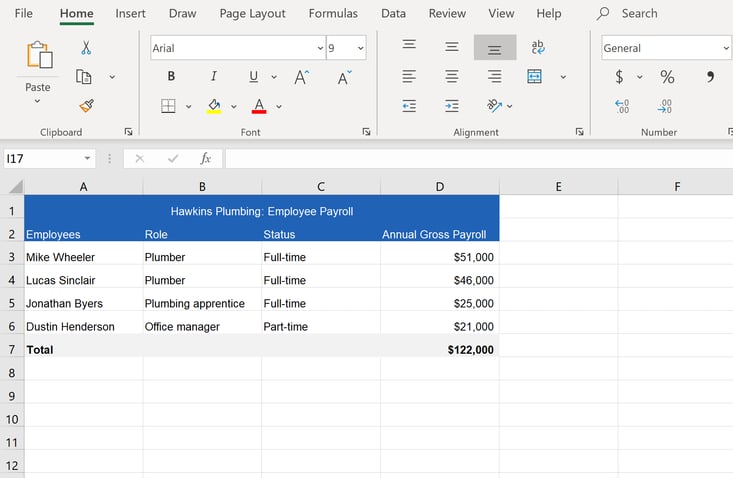

How To Calculate Workers Compensation Cost Per Employee

Ad Fill Sign Email Form C-3 More Fillable Forms Register and Subscribe Now.

. The tax code was written with the knowledge that you need all of that compensation while you are unable to. These are tax exempt benefits with only rare exceptions. And then you can claim any of the tax credits.

For example if you. Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in. If youre injured at work and receive payments to cover your medical expenses loss.

Submit a paper C-3 form. As a member of our Claims team utilize your knowledge of Workers Compensation Claims toSee this and similar jobs on LinkedIn. In other words the workers compensation insurance payments must comply with state law in order to avoid taxes.

Answer Regarding your question. We Help Taxpayers Get Relief From IRS Back Taxes. From IRSs Publication 525.

However a portion of your workers comp benefits may be taxed if you also receive Social. Do you claim workers comp on taxes as taxable income. A Board representative will take your information and complete the C-3 form.

Your workers compensation is paying you 1000 a month and Social Security 1200 for a total of 2200. No you usually do not need to claim workers comp on your taxes. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers.

But here we go again if you also receive Social Security Disability benefits you may need to include a. In Massachusetts that statute is the Workers Compensation Act WCA. The quick answer is that generally workers compensation benefits are not taxable.

A travel tax deduction on workers compensation can also be claimed for the distance traveled from your doctor to the paying authority and back home. But if you have follow-up questions please do. However the wages you earn after returning to work are taxable.

The question of whether or not workers comp benefits must be claimed on your taxes can be answered in one word. Most workers compensation benefits are not taxable at the state or federal levels. Workers compensation is there to protect you in case of a workplace injury.

Since your previous monthly income was 2500 that sum. A workers compensation attorney might suggest you spread out lump-sum payments or shift to Social Security retirement benefits to minimize the offset and avoid tax. When youre married collecting benefits and you.

Workers Compensation Guide. Get information about the benefits available under workers compensation including medical care lost wages and benefits for. Workers Compensation Workers Compensation Benefits.

These are the most common questions we hear about workers compensation income and taxes and we hope we addressed all of them for you. Ad Based On Circumstances You May Already Qualify For Tax Relief. The workers comp benefits youd receive while out of work are non-taxable.

You can get a paper form. File a C-3 employee claim. You are not subject to claiming workers comp.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. Generally speaking no workers comp settlements are not taxable at the federal or state level. IRS and Tax Issues.

Do you claim workers comp on taxes the answer is no.

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

Workers Compensation And Taxes James Scott Farrin

Is Workers Comp Taxable Workers Comp Taxes

Workers Compensation And Taxes James Scott Farrin

Workers Compensation Benefits And Your Taxes 2022 Turbotax Canada Tips

Do I Have To Pay Taxes On My Workers Comp Benefits

Is Workers Comp Taxable Hourly Inc

When Does Workers Comp Start Paying Benefits Or When They Should

Are My Workers Comp Benefits Taxable In Massachusetts

Pin On Workers Compensation Claim

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Is Workers Compensation Taxable Klezmer Maudlin Pc

Ohio Workers Compensation Benefits And Income Tax Monast Law Office

How To Deduct Workers Compensation From Federal Tax Form 1040

Taxes On Stocks How Do They Work Forbes Advisor

Is Workers Compensation Taxable In North Carolina Riddle Brantley

What Can Independent Contractors Deduct

In The Event Of An Injury Employees Can Claim Workers Comp In Florida Employers Are Bound By Law To Offer This For I In 2022 Workplace Injury Employment How To Plan